Repayment conditions are dependant on the agreement among your business plus your business lender. Repayment durations can range from as brief as six months to as long as 5 many years or even more. To secure the ideal business loan suited to you, ensure the repayment terms align with your monetary planning.

Of course. Cookies are small files that a web site or its services service provider transfers towards your Computer system's hard disk drive by means of your Website browser (in case you allow for) that allows the site's or services company's techniques to acknowledge your browser and capture and don't forget particular information. For illustration, we use cookies that will help us keep in mind and system the goods within your purchasing cart.

Look at how briskly you'll need The cash. Some regular loans acquire months, whilst online lenders can fund your account within 24 to 48 hours. If timing is vital, make certain your lender can supply on timetable.

In case you’re hunting for a governing administration-backed loan, you’ll require to use through an SBA-approved lender. These lenders offer you loans with reduced down payments and prolonged phrases, making them perfect for small businesses on the lookout for inexpensive financing solutions.

Present Constant Profits: Demonstrating dependable earnings as time passes will guarantee lenders that the business is lucrative and able to repaying the loan.

Best line of credit for small businesses and start-ups: Fundbox Fundbox is often a fintech that makes capital accessible to businesses by business loans and lines of credit originated by Initial Digital Lender or Lead Bank. Ideal for businesses searching for adaptable repayment conditions: Ondeck Ondeck is really a fintech aiding borrowers uncover suited financing utilizing partnership relationships. Most effective for business owners seeking to invest in stock using a line of credit: Headway Capital Headway Capital will not be a financial institution but rather a fintech functioning as being a small business lender. Ideal line of credit for businesses in services-centered industries: Fora Economic Fora Economic Business Loans LLC can be a fintech and not a financial institution. Best line for recognized businesses needing shorter-term financing: American Categorical American Categorical is actually a fintech working like a economic service company and collaborating with other fintech partners. Finest business line of credit lenders fast comparison

Some industries depend upon lines of credit more than Other folks. If the business has fluctuating income movement, seasonal desire, or normal stock requires, a line of credit can give a great possibility.

Soon after repayment, there is no must share income with the lender. This also reduces administrative responsibilities by doing away with the necessity for shareholder meetings and votes. Also, loans You should not require a similar polices on investments.

Constructing relationships with lenders can noticeably enhance how to get approved for a business line of credit your possibilities of securing a small business loan. Attend networking events, have interaction with loan officers, and set up rapport with critical contacts at financial institutions or lending institutions.

Your credit line equals your deposit with the option to graduate to an unsecured line of credit in excess of timeadatext

Whether or not you’re trying to launch your desire business, scale your company and mature, or simply just looking for capital to have by way of a slow period of time, small business loans can offer the resources you'll want to switch your business strategy into a hit.

You'll be able to accessibility distinctive business loans with a standard lender or credit union. Usually, these lenders give competitive costs and conditions, but specifications may be relatively rigid, generally requiring a reliable credit heritage and profits, furthermore many years in business. You might also really need to pay back extra fees and provide collateral to secure the funds.

Business credit card: A business credit card is another method of revolving credit where you only buy Everything you use. The most significant difference between business lines of credit and credit cards is the fact credit playing cards carry bigger fascination costs than lines of credit. Having said that, Additionally they usually come with reward packages that a lot of lines of credit don’t give.

Lenders intensely contemplate your individual and business credit history when assessing loan apps. To help your creditworthiness, ensure your credit experiences are correct, solve any superb troubles, and make timely payments on existing debts.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Angus T. Jones Then & Now!

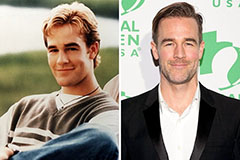

Angus T. Jones Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!